The Futility of Timing the Market: A Lesson in Real Estate

In the world of investing, there is a prevalent temptation to try to time the market, to predict its ups and downs with precision. Many people believe that by jumping in and out of the market at the right moments, they can maximize their returns and avoid losses. However, history and the wisdom of seasoned investors and real estate professionals…cough, cough, your favorite Properties on the Potomac agent… have repeatedly shown that timing the market is an exercise in futility. Let’s shed some light on the fallacy of market timing and highlight the benefits of a strategic long-term approach to real estate.

1. The Myth of Perfect Timing:

Timing the real estate market involves predicting when to enter or exit the market with the expectation of making significant gains. Unfortunately, accurately predicting short-term fluctuations in the housing market is a daunting task. Real estate markets are influenced by numerous factors, such as economic conditions, interest rates, supply and demand, and local factors, making it nearly impossible to consistently time the market successfully.

2. Emotional Pitfalls and FOMO (fear of missing out):

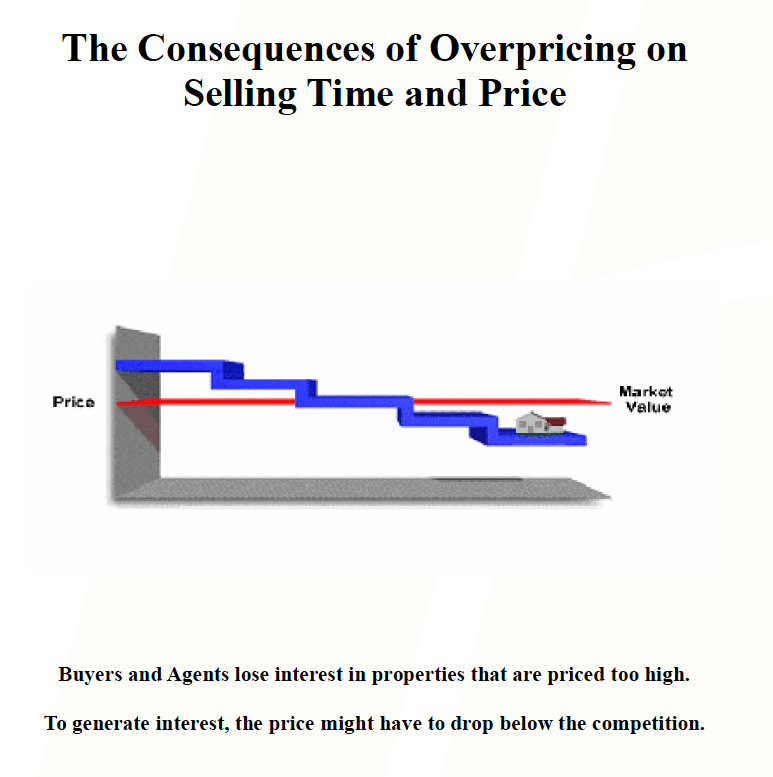

Attempting to time the real estate market often leads to emotional decision-making, driven by the fear of missing out on potential profits. Buyers may rush into purchasing a home during a market upswing, fearing that prices will rise further, potentially overpaying for a property. On the other hand, sellers may hold onto their homes during a market downturn, hoping for prices to rebound, potentially missing out on better opportunities. Emotions can cloud judgment and lead to poor real estate decisions.

3. Long-Term Market Trends and Cycles:

Real estate markets are subject to cyclical patterns and long-term trends. While short-term fluctuations may occur, over the long term, real estate has historically shown overall growth. Instead of trying to time the market, buyers and sellers can benefit from understanding these broader trends and making informed decisions based on their individual circumstances and goals. A strategic long-term approach allows individuals to navigate the market cycles with greater stability and confidence.

4. Financial Considerations and Transaction Costs:

Timing the real estate market often involves frequent buying and selling, which comes with financial implications. Costs such as real estate agent commissions, closing costs, and potential capital gains taxes can eat into potential profits. Moreover, attempting to time the market may lead to hasty decisions, resulting in undesirable outcomes or the need for costly corrective actions. A long-term approach to real estate transactions minimizes unnecessary expenses and maximizes financial gains.

5. Location and Individual Circumstances:

The value of real estate is heavily influenced by location and individual circumstances. Factors such as job opportunities, local amenities, infrastructure development, and demographic shifts can significantly impact property values. Rather than focusing on market timing, individuals should prioritize thorough research and analysis of the local market conditions, as well as their own specific needs and financial situation. Making informed decisions based on these factors is more likely to yield favorable outcomes.

Timing the real estate market requires careful consideration and a comprehensive understanding of various factors. Don’t let the allure of market timing lead to unnecessary risks and missed opportunities. Instead, take a proactive approach by reaching out to our team of experienced real estate professionals.

Properties on the Potomac can provide valuable insights, personalized guidance, and assist you in making informed decisions tailored to your unique needs. Contact us at 703-624-8333 today to start your journey towards successful real estate transactions.