Landlords and Rental News

Knowledge of Laws and Legislation is Power

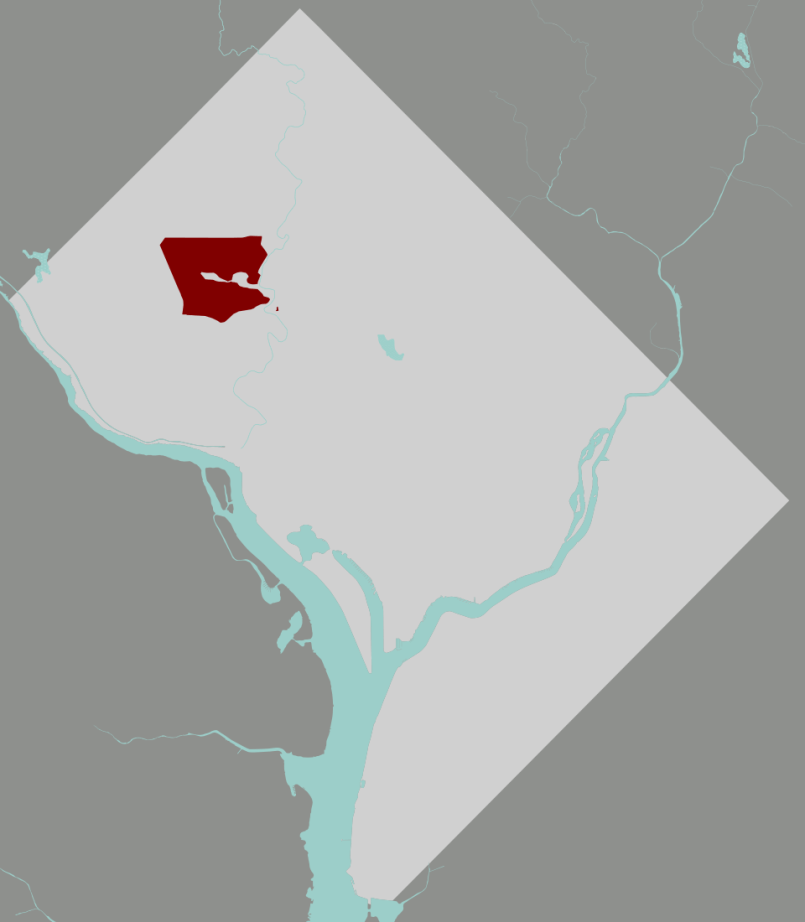

Rentals. Their management and tenancy are a significant part of real estate ownership. At Properties on the Potomac, we follow legislative updates in all three of our jurisdictions: Virginia, Maryland, and Washington, D.C. Each has its own landlord-tenant laws that must be carefully observed.

As professionals, we help property owners secure good tenants who care for their homes. We do this across all three jurisdictions. We also assist past clients who are transitioning into rentals for lifestyle changes or interim situations.

Unlike residential sales, rentals are governed largely by statute. Landlord-tenant laws affect day-to-day operations, which can significantly impact a landlord’s finances.

Affordable housing is a major topic today. Alongside that discussion, tenant rights and landlord obligations are receiving increased attention. Maryland has already enacted stricter rules involving security and pet deposits. Virginia is considering several similar measures.

Security Deposit rules by jurisdiction

(their refund rules will be addressed in a future blog):

Washington, D.C.

All security deposits must be held in FDIC-insured escrow accounts and must accrue interest.

Maryland

Security deposits are limited to one month’s rent. Pet deposits are not allowed, though landlords may negotiate non-refundable rent increases related to pets. All deposits must be held in FDIC-insured escrow accounts.

Virginia

There is currently no cap on security deposits, and no escrow or interest requirement. However, this may change with pending legislation.

Delinquent Rents and Eviction Initiation

Washington, D.C.

Landlords must provide 30 days written notice of nonpayment. Tenants may cure during that period.

Maryland

Tenants generally have 10 days to pay or vacate. The eviction process itself is often lengthy.

Virginia

Currently requires a 5-day pay-or-quit notice. Proposed legislation would extend this to 14 days.

It is critical that landlords follow the rules of their jurisdiction. Failure to comply can result in loss of deposits, unnecessary repair responsibilities, fines, and delayed legal action.

For many landlords, working with a professional property manager helps reduce risk and keeps operations compliant.

Virginia Legislative Updates – 2026 Session

When I attended the Northern Virginia Association of Realtors Legislative Day in Richmond on January 29, I learned about several landlord-tenant bills currently under consideration in the Virginia General Assembly. Many could meaningfully affect landlords.

Eviction and Payment Reforms

• HB 15 (Price) — Extends the grace period for late rent payments from 5 days to 14 days before eviction proceedings may begin.

• HB 95 (Bennett-Parker) — Requires landlords to offer payment plans of up to six months to tenants behind on rent before terminating a lease.

• HB 281 (Callsen) / SB 373 (Boysko) — Removes the requirement for tenants to pay disputed rent into court before asserting legal defenses.

• HB 837 (McClure) / SB 273 (Locke) — Updates the Eviction Diversion Program’s eligibility and notification process.

Fees and Maintenance

• SB 313 (Ebbin) / HB 1005 (Price) — Prohibits landlords from charging for routine maintenance unless caused by a tenant’s lease violation.

• HB 1409 (Schmidt) — Bans certain charges for common-area utilities, delivery fees, and services beyond actual costs.

• SB 349 (Locke) — Limits pre-tenancy fees and requires full written disclosure prior to showings.

Tenant Protections

• HB 14 (Price) — Allows local governments to pursue legal action against landlords who fail to correct hazardous conditions.

• HB 1408 (Schmidt) — Expands protections for victims of family abuse.

• HB 1252 (McClure) — Requires disclosure of algorithmic rent-pricing tools and allows tenants to request human review.

• HB 329 (McClure) — Expands definitions of retaliatory conduct and tenant remedies.

Local Authority and Market Regulation

• HB 278 (Clark) — Allows local governments to adopt anti-rent gouging policies.

• SB 547 (Sturtevant) — Limits ownership of single-family homes by certain entities and requires public marketing periods.

As a current or prospective landlord, review these proposals and determine how they might affect your properties and investments. You have the right to address concerns or express support with your elected representative.

At Properties on the Potomac, we track legislative changes closely to help our clients stay informed and prepared.

If you own rental property and have questions, we are available to help. Text Broker, Krasi Henkel to discuss your questions.