Kitchen Updates That Sell: The Sweet Spot Between Budget and Luxury

When it comes to selling your home, the kitchen remains the heart of the house and often the deal-maker or breaker. But finding the perfect balance between impactful updates and smart spending can be tricky. Let’s explore how to maximize your kitchen’s appeal without overspending or under-improving.

The Smart Money Zones

The most impactful kitchen updates often focus on three key areas:

1. Countertops: Granite is no longer the automatic go-to. Consider these mid-range options that offer both beauty and value:

- Quartz composites: Offer durability and style without the maintenance of natural stone

- Butcher block: Add warmth and character at a reasonable price point

- High-end laminate: Modern options mimic stone so well that buyers often can’t tell the difference

2. Cabinetry: Full cabinet replacement isn’t always necessary. Consider these strategic updates:

- Cabinet refacing: About 30-50% cheaper than replacement while providing a completely new look

- Paint and hardware: A professional paint job and modern hardware can transform dated cabinets for under $5,000

- Selective replacement: Replace only the most visible or damaged cabinets while refinishing others

3. Lighting: Good lighting can make even modest updates look high-end:

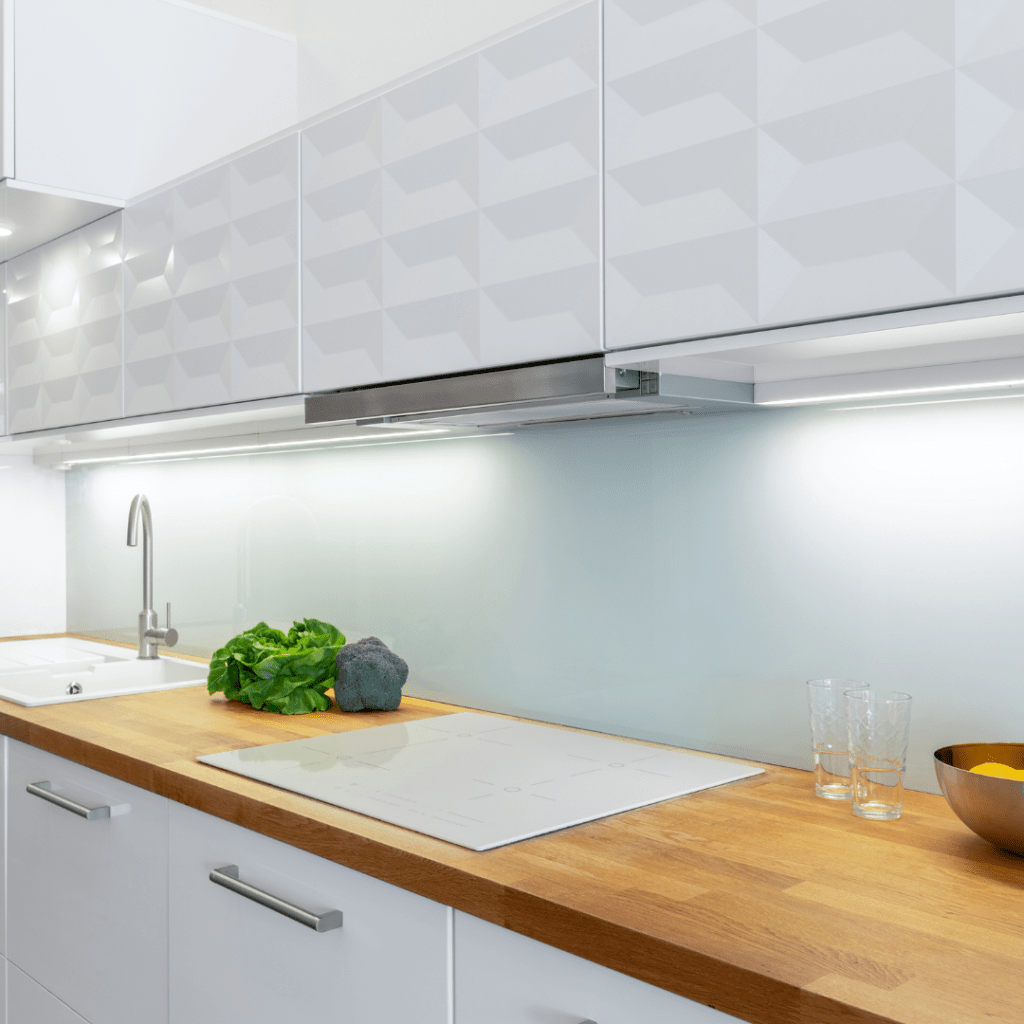

- Under-cabinet LED strips: Create ambiance and functionality

- Statement pendant lights: Draw the eye and add contemporary flair

- Recessed lighting: Brighten dark corners and modernize the space

Cost-Effective High-Impact Updates

1. Backsplash: Choose classic subway tiles or geometric patterns in neutral colors. They’re affordable but look upscale when properly installed.

2. Sink and Faucet: A deep undermount sink and professional-style faucet can give the kitchen a high-end feel without breaking the bank.

3. Fresh Paint: Choose warm neutrals or soft whites to make the space feel clean and inviting. Paint delivers the highest return on investment of any single update.

Where to Save vs. Splurge

Save On:

- Appliances: Mid-range, matching appliances often provide better ROI than high-end models

- Hardware: Shop retail sales for cabinet pulls and knobs

- Flooring: Luxury vinyl plank offers durability and style at a fraction of hardwood’s cost

Splurge On:

- Professional installation: Poor workmanship can devalue even expensive materials

- Quality faucets: They’re frequently used and scrutinized by buyers

- Lighting fixtures: They serve as jewelry for your kitchen

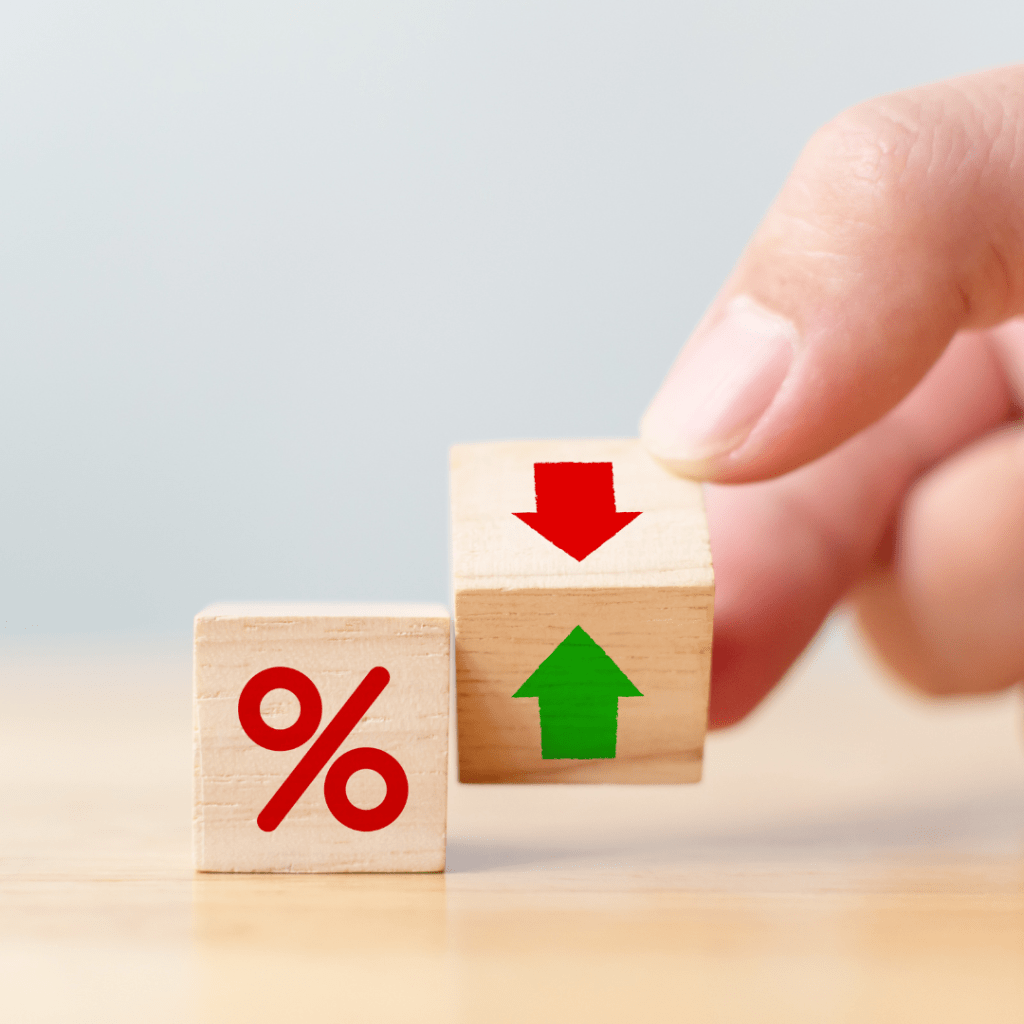

The Numbers That Matter

Based on recent market data:

- Minor kitchen remodel average cost: $23,452

- Value recouped at sale: 77.6%

- Sweet spot budget range: $15,000-30,000

Avoid Common Mistakes

- Don’t over-customize: Keep updates neutral and broadly appealing

- Skip trendy choices: They can quickly date your kitchen

- Maintain proportion: Ensure updates match your home’s overall value 4. Consider your timeline: If selling within a year, focus on visual impact over durability

The Bottom Line

The key to a successful kitchen update is understanding your market and your buyers. In most cases, you’ll see the best return by creating a fresh, modern look without going overboard on high-end finishes. Focus on clean lines, neutral colors, and quality materials in the mid-range price point.

Remember: The goal isn’t to create the most expensive kitchen on the block, but rather the most appealing one within a reasonable budget. This approach not only attracts buyers but also provides the best return on your investment.

Need help planning your kitchen update? Let’s talk about what makes sense for your home and market. Contact Krasi Henkel at 703-624-8333 today for a personalized consultation and market analysis.