Finding an Excellent Realtor®: Your Guide to Real Estate Success

Finding the right real estate professional to advise and guide you through the acquisition or sale of one of your largest assets can make all the difference in your real estate journey. Whether buying your dream home or selling a property, an excellent Realtor® doesn’t just facilitate transactions—they provide expertise, guidance, and peace of mind during one of life’s most significant financial decisions.

Why the Right Realtor® Matters

The real estate market can be complex and competitive. An excellent Realtor® brings market knowledge, negotiation skills, and professional connections that can save you time, money, and stress. They’ll help you navigate state and federal rules, paperwork, deadlines, and potential pitfalls while advocating for your best interests.

The Realtor® Advantage

Working with a Realtor® who is a member of the National Association of Realtors (NAR) provides significant advantages due to their commitment to a strict Code of Ethics. NAR members pledge to protect and promote their clients’ interests while treating all parties honestly.

The Code of Ethics goes beyond legal requirements, holding these real estate professionals to high standards of integrity, professionalism, and fairness in all transactions. This ethical framework ensures that the Realtor® provides accurate information, discloses potential conflicts of interest, and maintains confidentiality.

Their commitment to these principles means clients receive more transparent, ethical representation throughout the complex real estate process. Ultimately this leads to informed decisions and smoother transactions with reduced risk of miscommunication or ethical breaches.

How to Find Your Ideal Realtor®

Ask for Recommendations

Start by tapping into your personal network. Friends, family members, and colleagues who have recently bought or sold property can provide honest feedback about their experiences. Ask specific questions about what made their Realtor® exceptional or disappointing.

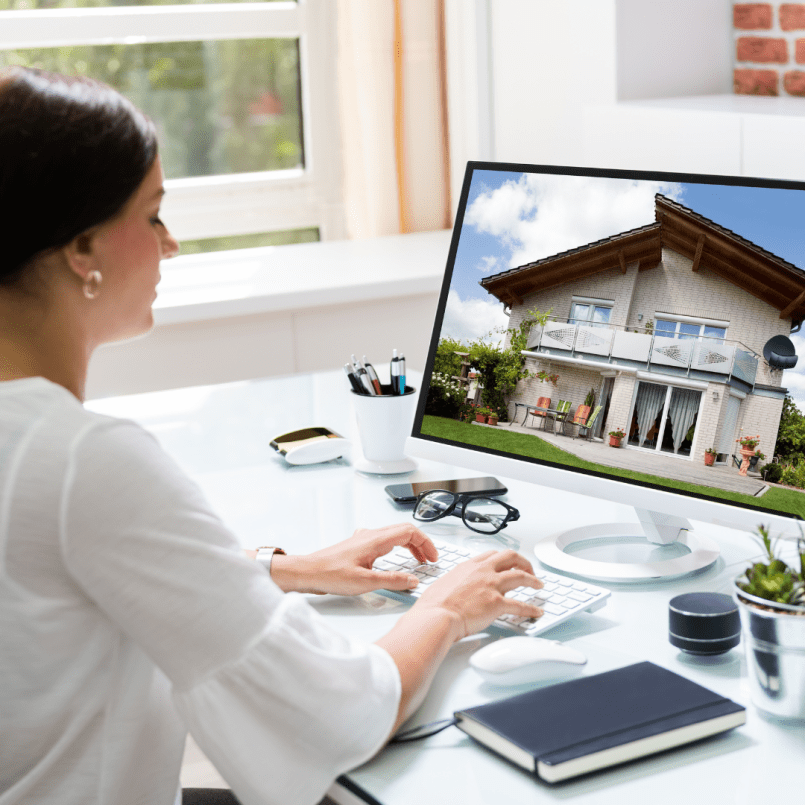

Research Online Presence and Reviews

Once you have some names, investigate their online presence:

- Check their professional website and social media accounts

- Read client reviews on platforms like Zillow, Realtor.com, and Google

- Focus on feedback about communication, market knowledge, and negotiation skills

Verify Credentials and Experience

Make sure your potential real estate professional is:

- Licensed in your state

- A Realtor®; not merely a salesperson

- An expert in your type of transaction (first-time buying, luxury homes, investment properties, etc.)

- Holds relevant certifications or additional training

Interview Multiple Candidates

Schedule interviews with several realtors. During these conversations:

- Discuss your specific needs and timeline

- Ask about their recent transactions and success rates

- Inquire about their communication styles and availability

- Request examples of how they have handled challenging situations

- Discuss what services you expect

Look for Local Expertise

A Realtor® with extensive knowledge of your target neighborhood or property type can provide invaluable insights about:

- Market values

- School districts

- Community amenities

- Future development plans

- Property tax trends

- Local regulations and zoning

Assess Communication Skills

Pay attention to how promptly and clearly they respond to your inquiries. Your Realtor® should:

- Be responsive and professional

- Listen deeply to your needs and concerns

- Ask questions to verify their understanding and confirm your goals

- Explain complex concepts in understandable terms

- Provide regular and relevant updates throughout the process

- Be honest, even when the news isn’t what you want to hear

Trust Your Instincts

Beyond credentials and recommendations, consider personal compatibility. You will be working closely with this person. Mutual trust and respect are essential.

Red Flags to Watch For

Be cautious of agents who:

- Pressure you to make quick decisions

- Are difficult to reach or slow to respond

- Dismiss your questions or concerns

- Can’t provide references from recent clients

- Have limited knowledge of your target area

- Promise unrealistic outcomes

Final Thoughts

Taking the time to find an excellent Realtor® is an investment that pays dividends throughout your real estate journey. The right professional will not only help you achieve your property goals but will also make the process smoother and less stressful.

One potential concern for buyers and sellers is that the exceptional Realtor’s guard their time. They do so because they give optimal services to their clients. Most top Realtor’s establish their annual goals as to how many clients they can and want to represent during the year. If you are considering a real estate transaction with a top Realtor® be sure to get on their calendars early.

Remember that you’re hiring someone to provide a service—ask questions, check references, and ensure the right fit for your needs. With the right Realtor® by your side, you will be well-positioned to navigate the real estate market effectively.