6 Traits of Successful Homebuyers and Sellers

Properties on the Potomac has helped countless clients buy and sell homes. Over the years, we’ve noticed some common traits and habits that the most successful homebuyers and sellers exhibit. If you want to set yourself up for real estate success, here are 6 traits our clients share:

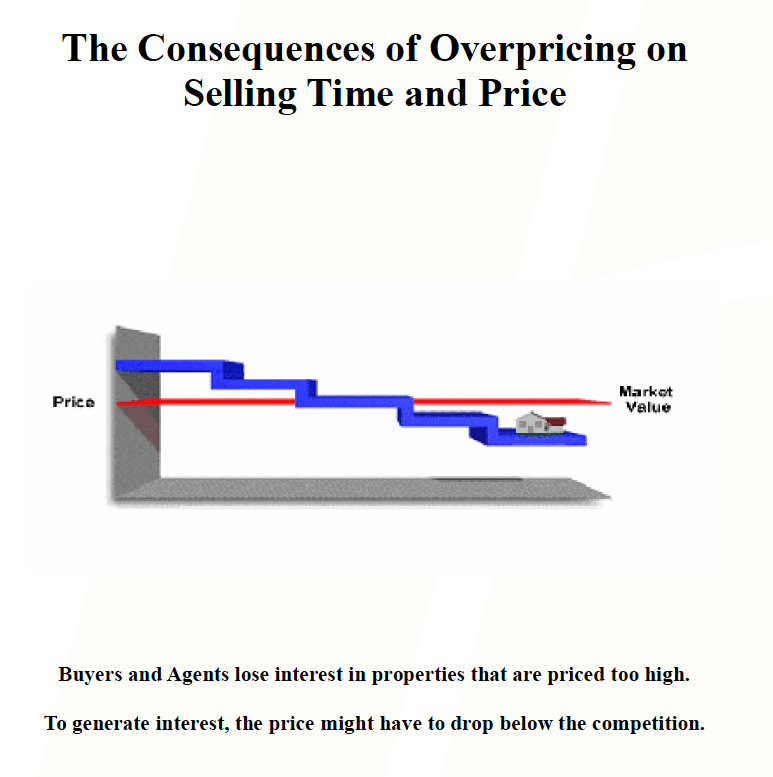

- They know their numbers. Successful buyer clients understand their finances. They know their credit scores, debt-to-income ratios, and how much they can comfortably afford. Successful selling clients understand the market and follow our pricing advice.

- They are realistic about timing. Our successful clients realize that buying or selling a home takes time. They start the process well in advance of when they need to move.

- They know what they want. Successful clients have clear “must haves” and “would like to haves” prioritized for their home search. Our selling clients have clear goals for their sale.

- They declutter and clean. For sellers, our most successful clients thoroughly declutter and clean their home before listing. They follow our recommendations for “facelifts” to optimize their returns. This helps showcase the property and helps buyers envision living there.

- They trust their agent. Successful clients lean on their agent’s expertise. They understand we’re looking out for their best interests through every step.

- They stay calm through challenges. Even if issues arise, successful clients take problems in stride. They stay focused on their goals.

If you cultivate these habits and mindsets, you’ll be well on your way to real estate success. Give Properties on the Potomac a call at 703-624-8333 to help make your real estate dreams a reality. With over 100 years of combined experience in the DC area, we bring our clients nothing but the best!