Bridging Cultures Through Business: Insights from the French-American Chamber of Business Summit

Banner image: Leadership and mentorship discussion, Diana Bell-McKoy

As a real estate professional constantly seeking to expand my horizons and connections, I recently had the privilege of attending the French-American Chamber of Commerce Business Summit on May 1st at the Embassy of France. This gathering proved to be far more than a typical networking event. It was a vibrant celebration of cross-cultural collaboration and innovation right here, in the DC Metro area.

A Feast for Mind and Palate

The Embassy of France provided an elegant backdrop for this meeting of minds, and true to French tradition, the culinary offerings were nothing short of spectacular. From the carefully curated breakfast pastries to the sumptuous lunch spread, the attention to detail reflected the French commitment to excellence that permeated the entire summit. And of course, French Champagne.

While the food nourished the body, it was the intellectual exchange that fed the soul. Speakers from diverse sectors shared cutting-edge technological developments, innovative marketing approaches, mentorship programs, and even artistic perspectives that bridge our two cultures. The breadth of knowledge on display was both impressive and humbling.

Tomorrow’s Leaders Today

Among the most inspiring aspects of the summit was meeting several French interns currently working at the Embassy. Their enthusiasm, professionalism, and global perspective were remarkable. These young professionals embodied the future of international relations. They were fluent not just in multiple languages but in the nuanced art of cross-cultural communication.

Their presence reminded me that in real estate, we’re not just selling properties; we’re facilitating lives in new communities. Whether helping expatriates find their American home or assisting locals looking to embrace new cultural experiences, understanding diverse perspectives enriches our ability to serve clients meaningfully.

Technology and Humanity: Finding the Balance

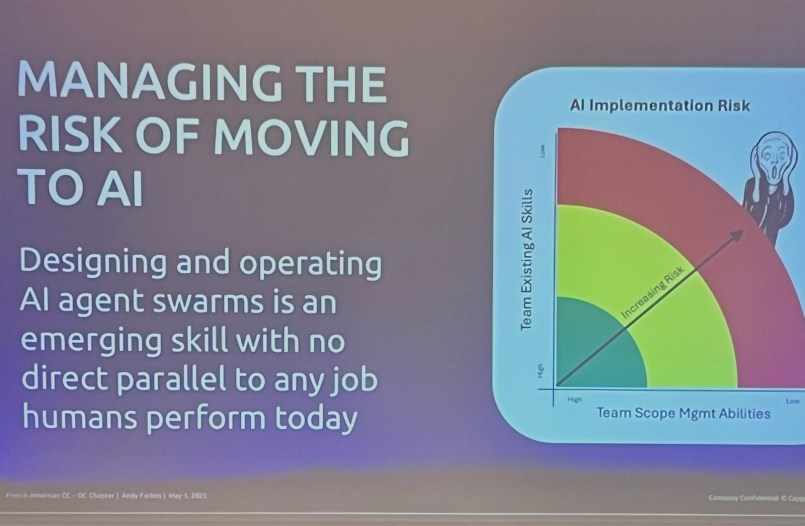

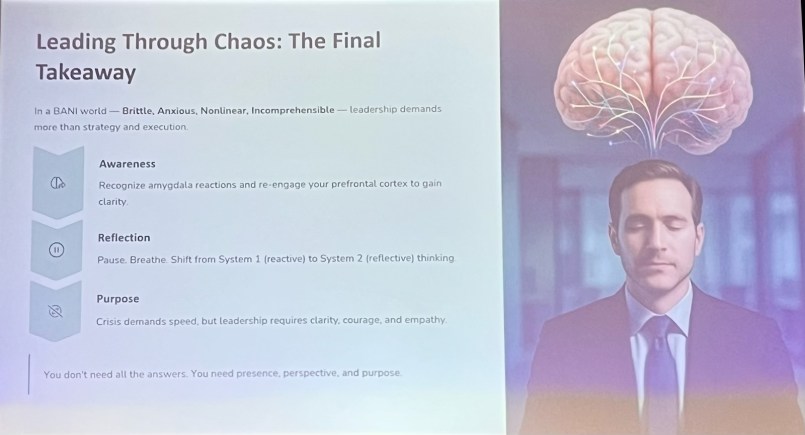

A recurring theme throughout the presentations was the role of technology in modern business. Speakers showcased impressive advances in various fields—from golf lawn mowing robots to marketing strategies and Woman-on-Woman mentorship, there were limitless applications for real estate.

The most profound takeaway came not from discussions of technology but from experiencing its limitations. Despite all our digital connections—emails, texts, social platforms, and virtual meetings that fill our days, nothing replaces the energy of face-to-face conversation. As attendees exchanged ideas over coffee or shared business cards after presentations, it became abundantly clear: human connection remains the foundation of meaningful business relationships.

Bringing It Home to Properties on the Potomac

At Properties on the Potomac, we value the human element of real estate. The insights gained from this summit reinforce our commitment to combining technological efficiency with personal connection. In our communities, where history and innovation flow together like the waters of the Potomac, this balanced approach resonates deeply.

The French-American Chamber of Commerce exemplifies how different perspectives can create something greater than the sum of their parts. Similarly, in real estate, bringing together diverse clients, properties, and communities creates value that transcends transaction.

As I reflect on the day’s experiences, I’m reminded that bridges, whether between cultures, businesses, or people seeking new homes, are not built with technology alone. They require understanding, patience, and genuine human interest. In our increasingly digital world, these qualities may well be the most valuable currency of all.

The summit may have ended, but its impact continues. As a Certified International Property Specialist, I look forward to incorporating these cross-cultural insights into our work at Properties on the Potomac, Inc., where each client’s story adds another chapter to our community’s rich narrative.

In keeping with the international theme of the day, I had the pleasure of dining with a client who is Bulgarian. After a day of hearing French and partially conversing in it, I switched to Bulgarian and ended the day on a note of optimistic plans for my client. In spite of being up since 5 AM, I was still energized when I walked through my door after 10 PM.