Exploring Cultural Architectural Influences

At Properties on the Potomac, we are deeply immersed in the realms of architecture and design; we constantly seek inspiration from diverse cultural perspectives. Recently, our company embarked on a transformative journey during our board retreat in Cancun, Mexico. Surrounded by the vibrant hues of the Caribbean Sea and the rich tapestry of Mexican architecture, we found ourselves captivated by the interplay of cultural influences on architectural approaches.

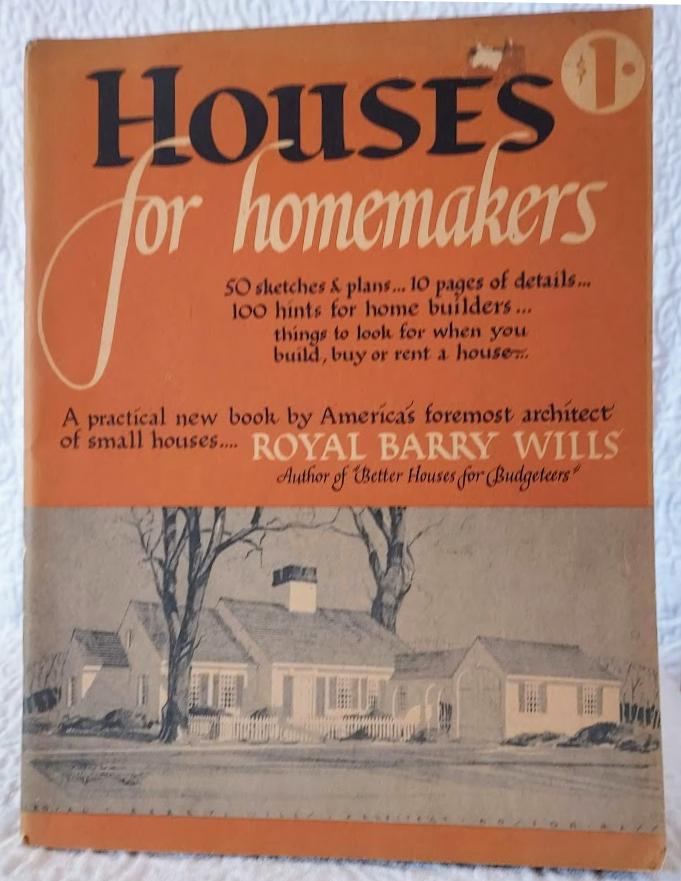

Our retreat provided a unique opportunity to delve into the intricate fusion of Mexican and American architectural styles. In Mexico, architecture is not merely about structural aesthetics; it’s a narrative woven with threads of history and tradition. From the awe-inspiring Mayan ruins to the colorful facades of colonial buildings, every edifice tells a story of resilience, innovation, and cultural amalgamation. The juxtaposition of ancient indigenous designs with modernist elements showcases a seamless integration of tradition and innovation, a principle we strive to embody in our real estate endeavors.

Similarly, in the United States, architecture serves as a testament to the nation’s diversity and vitality. From the iconic skyscrapers of New York City to the sprawling suburban landscapes of California, American architecture mirrors the country’s spirit of ingenuity and ambition. The fusion of architectural styles from different eras and cultures creates a rich tapestry of urban landscapes, reflecting the ever-evolving societal values and aspirations.

Our retreat in Cancun served as a catalyst for introspection, inspiring us to infuse our real estate projects with the essence of cultural diversity and historical resonance. We are committed to crafting spaces that transcend mere functionality, embodying the soul and spirit of the communities they serve.

Join us on this journey of architectural exploration and cultural appreciation. Let us embark together on a quest to create spaces that resonate with the stories of the past and the aspirations of the future. Reach out to us at 703-624-8333 today to discover how we can assist in bringing your vision to life, whether it’s finding an existing home or building a new home.